Kindly attach proper documentation with your consignment for a seamless shipping experience.

We humbly request you to consider visiting official government websites for the appropriate documents required for shipping. Kindly keep your proper documents handy, as we do not take responsibility for any mishap due to lack of documentation.

GST / TRANSPORTER ID

| S. No. | State | Transpoter ID | SAC Code |

|---|---|---|---|

| 1 | NATIONAL TRANSPORT ID | 07AABCC8298E1ZH | 996812 |

E-WAY BILL

The e-way bill is an important document required for the movement of goods.

It is mandatory if you are moving goods worth more than INR 50,000 from one place to another. Each e-way bill must have detailed information about the goods being transported.

Additionally, you need an E-way bill to transport goods worth less than INR 50,000 if they are handicraft goods or goods for inter-state job work.

Exceptions when e-way bill are not required:- E-way bill is optional for goods with a value less than INR 50,000 (except in the cases of mandatory E-way bill provisions like the movement of handicraft goods and movement of goods for inter-state job work).

- If goods are transported by a non-motorised conveyance (e.g. horse carts or manual carts).

- If goods are being transported from the port, airport, air cargo complex and land customs station to an inland container depot (ICD) or a container freight station (CFS) for clearance by customs, from ICD or CFS to a customs port, airport, air cargo etc. under customs bond, from one customs port/station to another one under customs bond, goods transported under customs supervision or customs seal.

- Goods transported within the notified area.

- Goods transported are in transit from/to Nepal or Bhutan.

- Goods transported are to/from the Ministry of Defence.

- If goods are being transported to a weighbridge within 20 km and back to the place of business by being covered under a delivery challan.

- If government or local authorities transport goods by rail as a consignor.

- Used personal and household goods.

Experience flawless cross-border shipping with the following

documentation guide.

9 Classes of Dangerous Goods

‘Dangerous goods’ are materials or items with hazardous properties which, if not properly controlled, present a potential hazard to human health and safety, infrastructure or their means of transport.

The transportation of dangerous goods is controlled and governed by a variety of different regulatory regimes, operating at both the national and international levels. Prominent regulatory frameworks for the transportation of dangerous goods include the United Nations Recommendations on the Transport of Dangerous Goods, ICAO’s Technical Instructions, IATA’s Dangerous Goods Regulations and the IMO’s International Maritime Dangerous Goods Code. Collectively, these regulatory regimes mandate how dangerous goods are to be handled, packaged, labelled and transported.

Regulatory frameworks incorporate comprehensive classification systems of hazards to provide a taxonomy of dangerous goods. Classification of dangerous goods is broken down into nine classes according to the type of dangerous materials or items present, click on a class to read more details.

Here is the curated list of prohibited goods for shipping.

| S. No. | Items |

|---|---|

| 1. | Explosives |

| 2. | Flammable Gases |

| 3. | Flammable Liquids |

| 4. | Flammable Solids |

| 5. | Oxidising |

| 6. | Toxic & Infectious |

| 7. | Radioactive |

| 8. | Corrosives |

| 9. | Miscellaneous |

Explosives are materials or items that can rapidly conflagrate or detonate as a consequence of chemical reactions.

DGI are proficient in handling explosives, Class 1 Dangerous Goods. DGI can service all customer requests pertaining to the logistics of explosives; packing, packaging, compliance, freight forwarding and training.

Reason for RegulationExplosives are capable by chemical reaction of producing gases at temperatures, pressures and speeds to cause catastrophic damage through force and/or of producing otherwise hazardous amounts of heat, light, sound, gas or smoke.

Sub-Divisions Division 1.1: Substances and articles which have a mass explosion hazard.Division 1.2: Substances and articles which have a projection hazard but not a mass explosion hazard.

Division 1.3: Substances and articles which have a fire hazard and either a minor blast hazard, and/or a minor projection hazard or both.

Division 1.4: Substances and articles which present no significant hazard; only a small hazard in the event of ignition or initiation during transport with any effects largely confined to the package.

Division 1.5: Very insensitive substances which have a mass explosion hazard.

Division 1.6: Extremely insensitive articles which do not have a mass explosion hazard.

Commonly Transported Explosives

Ammunition/cartridges, Fireworks/pyrotechnics, Flares, Blasting caps/detonators, Fuse, Primers, Explosive charges (blasting, demolition etc.), Detonating cord, Air bag inflators, Igniters, Rockets, TNT/TNT compositions, RDX/RDX compositions, PETN/PETN compositions

Class 2: GasesGases are defined by dangerous goods regulations as substances which have a vapour pressure of 300 kPa or greater at 50°c or which are completely gaseous at 20°c at standard atmospheric pressure, and items containing these substances. The class encompasses compressed gases, liquefied gases, dissolved gases, refrigerated liquefied gases, mixtures of one or more gases with one or more vapours of substances of other classes, and articles charged with a gas and aerosols.

DGI are proficient in handling gases, Class 2 Dangerous Goods. DGI have the ability to service all customer requests pertaining to the logistics of gases; packing, packaging, compliance, freight forwarding and training.

Reason for RegulationGases are capable of posing serious hazards due to their flammability, potential as asphyxiants, ability to oxidise and/or their toxicity or corrosiveness to humans.

Sub-Divisions Division 2.1: Flammable gasesDivision 2.2: Non-flammable, non-toxic gases

Division 2.3: Toxic gases Commonly Transported Gases

Aerosols, Compressed air, Hydrocarbon gas-powered devices, Fire extinguishers, Gas cartridges, Fertiliser ammoniating solution, Insecticide gases, Refrigerant gases, Lighters, Acetylene / Oxyacetylene, Carbon dioxide, Helium/helium compounds, Hydrogen/hydrogen compounds, Oxygen/oxygen compounds, Nitrogen/nitrogen compounds, Natural gas, Oil gas, Petroleum gases, Butane, Propane, Ethane, Methane, Dimethyl ether, Propene/propylene, Ethylene

Class 3: Flammable LiquidsFlammable liquids are defined by dangerous goods regulations as liquids, mixtures of liquids or liquids containing solids in solution or suspension which give off a flammable vapour (have a flash point) at temperatures of not more than 60-65°C, liquids offered for transport at temperatures at or above their flash point or substances transported at elevated temperatures in a liquid state and which give off a flammable vapour at a temperature at or below the maximum transport temperature.

DGI are proficient in handling flammable liquids, Class 3 Dangerous Goods. DGI have the ability to service all customer requests pertaining to the logistics of flammable liquids; packing, packaging, compliance, freight forwarding and training.

Reason for RegulationFlammable liquids are capable of posing serious hazards due to their volatility, combustibility and potential to cause or propagate severe conflagrations.

Sub-DivisionsThere are no subdivisions within Class 3, Flammable Liquids.?

Commonly Transported Flammable LiquidsAcetone/acetone oils, Adhesives, Paints/lacquers/varnishes, Alcohols, Perfumery products, Gasoline / Petrol, Diesel fuel, Aviation fuel, Liquid bio-fuels, Coal tar/coal tar distillates, Petroleum crude oil, Petroleum distillates, Gas oil, Shale oil, Heating oil, Kerosene, Resins, Tars, Turpentine, Carbamate insecticides, Organochlorine pesticides, Organophosphorus pesticides, Copper based pesticides, Esters, Ethers, Ethanol, Benzene, Butanols, Dichloropropenes, Diethyl ether, Isobutanol, Isopropyls, Methanol, Octanes

Class 4: Flammable Solids; Spontaneous Combustibles; ‘Dangerous When Wet’ MaterialsFlammable solids are materials which, under conditions encountered in transport, are readily combustible or may cause or contribute to fire through friction, self-reactive substances which are liable to undergo a strongly exothermic reaction or solid desensitised explosives. Also included are substances which are liable to spontaneous heating under normal transport conditions, or to heating up in contact with air, and are consequently liable to catch fire and substances which emit flammable gases or become spontaneously flammable when in contact with water.

DGI are proficient in handling flammable solids, Class 4 Dangerous Goods. DGI have the ability to service all customer requests pertaining to the logistics of flammable solids; packing, packaging, compliance, freight forwarding and training.

Reason for RegulationFlammable solids are capable of posing serious hazards due to their volatility, combustibility and potential to cause or propagate severe conflagrations.

Sub-Divisions Division 4.1: Flammable solidsDivision 4.2: Substances liable to spontaneous combustion

Division 4.3: Substances which, in contact with water, emit flammable gases Commonly Transported Flammable Solids; Spontaneous Combustibles; ‘Dangerous When Wet’ Materials

Alkali metals, Metal powders, Aluminium phosphide, Sodium batteries, Sodium cells, Firelighters, Matches, Calcium carbide, Camphor, Carbon, Activated carbon, Celluloid, Cerium, Copra, Seed cake, Oily cotton waste, Desensitised explosives, Oily fabrics, Oily fibres, Ferrocerium, Iron oxide spent, Iron sponge/direct-reduced iron (spent), Metaldehyde, Naphthalene, Nitrocellulose, Phosphorus, Sulphur

Class 5: Oxidisers; Organic PeroxidesOxidisers are defined by dangerous goods regulations as substances which may cause or contribute to combustion, generally by yielding oxygen as a result of a redox chemical reaction. Organic peroxides are substances which may be considered derivatives of hydrogen peroxide where one or both hydrogen atoms of the chemical structure have been replaced by organic radicals.

DGI are proficient in handling oxidising agents and organic peroxides, Class 5 Dangerous Goods. DGI have the ability to service all customer requests pertaining to the logistics of oxidising agents and organic peroxides; packing, packaging, compliance, freight forwarding and training.

Reason for RegulationOxidisers, although not necessarily combustible in themselves, can yield oxygen and in so doing cause or contribute to the combustion of other materials. Organic peroxides are thermally unstable and may exude heat whilst undergoing exothermic autocatalytic decomposition. Additionally, organic peroxides may be liable to explosive decomposition, burn rapidly, be sensitive to impact or friction, react dangerously with other substances or cause damage to the eyes.

Sub-Divisions Division 5.1: Oxidising substancesDivision 5.1: Organic peroxides Commonly Transported Oxidisers; Organic Peroxides

Chemical oxygen generators, Ammonium nitrate fertilisers, Chlorates, Nitrates, Nitrites, Perchlorates, Permanganates, Persulphates, Aluminium nitrate, Ammonium dichromate, Ammonium nitrate, Ammonium persulphate, Calcium hypochlorite, Calcium nitrate, Calcium peroxide, Hydrogen peroxide, Magnesium peroxide, Lead nitrate, Lithium hypochlorite, Potassium chlorate, Potassium nitrate, Potassium chlorate, Potassium perchlorate, Potassium permanganate, Sodium nitrate, Sodium persulphate

Class 6: Toxic Substances; Infectious SubstancesToxic substances are those which are liable either to cause death or serious injury or to harm human health if swallowed, inhaled or by skin contact. Infectious substances are those which are known or can be reasonably expected to contain pathogens. Dangerous goods regulations define pathogens as microorganisms, such as bacteria, viruses, rickettsiae, parasites, fungi, or other agents which can cause disease in humans or animals.

DGI are proficient in handling toxic and infectious substances, Class 6 Dangerous Goods. DGI have the ability to service all customer requests pertaining to the logistics of oxidising agents and organic peroxides; packing, packaging, compliance, freight forwarding and training.

Reason for RegulationToxic and infectious substances can pose significant risks to human and animal health upon contact.

Sub-Divisions Division 6.1: Toxic substancesDivision 6.2: Infectious substances Commonly Transported Toxic Substances; Infectious Substances

Medical/Biomedical waste, Clinical waste, Biological cultures/samples/specimens, Medical cultures/samples/specimens, Tear gas substances, Motor fuel anti-knock mixture, Dyes, Carbamate pesticides, Alkaloids, Allyls, Acids, Arsenates, Arsenites, Cyanides, Thiols/mercaptans, Cresols, Barium compounds, Arsenic/arsenic compounds, Beryllium/ beryllium compounds, Lead compounds, Mercury compounds, Nicotine/nicotine compounds, Selenium compounds, Antimony, Ammonium metavanadate, Adiponitrile, Chloroform, Dichloromethane, Hexachlorophene, Phenol, Resorcinol

Class 7: Radioactive MaterialDangerous goods regulations define radioactive material as any material containing radionuclides where both the activity concentration and the total activity exceed certain pre-defined values. A radionuclide is an atom with an unstable nucleus and which consequently is subject to radioactive decay.

DGI are proficient in handling radioactive material, Class 7 Dangerous Goods. DGI have the ability to service all customer requests pertaining to the logistics of radioactive material; packing, packaging, compliance, freight forwarding and training.

Reason for RegulationWhilst undergoing radioactive decay radionuclides emit ionising radiation, which presents potentially severe risks to human health.

Sub-DivisionsThere are no subdivisions within Class 7, Radioactive Material.

Commonly TransportedRadioactive ores, Medical isotopes, Yellowcake, Density gauges, Mixed fission products, Surface contaminated objects, Caesium radionuclides/isotopes, Iridium radionuclides/isotopes, Americium radionuclides/isotopes, Plutonium radionuclides/isotopes, Radium radionuclides/isotopes, Thorium radionuclides/isotopes, Uranium radionuclides/isotopes, Depleted uranium/depleted uranium products, Uranium hexafluoride, Enriched Uranium

Class 8: CorrosivesCorrosives are substances which by chemical action degrade or disintegrate other materials upon contact.

DGI are proficient in handling corrosives, Class 8 Dangerous Goods. DGI have the ability to service all customer requests pertaining to the logistics of corrosives; packing, packaging, compliance, freight forwarding and training.

Reason for RegulationCorrosives cause severe damage when in contact with living tissue or, in the case of leakage, damage or destroy surrounding materials.

Sub-DivisionsThere are no subdivisions within Class 8, Corrosives.

Commonly Transported CorrosivesAcids/acid solutions, Batteries, Battery fluid, Fuel cell cartridges, Dyes, Fire extinguisher charges, Formaldehyde, Flux, Paints, Alkylphenols, Amines, Polyamines, Sulphides, Polysulphides, Chlorides, Chlorosilanes, Bromine, Cyclohexylamine, Phenol / carbolic acid, Hydrofluoric acid, Hydrochloric acid, Sulfuric acid, Nitric acid, Sludge acid, Hydrogen fluoride, Iodine, Morpholine

Class 9: Miscellaneous Dangerous GoodsMiscellaneous dangerous goods are substances and articles which during transport present a danger or hazard not covered by other classes. This class encompasses but is not limited to, environmentally hazardous substances, substances that are transported at elevated temperatures, miscellaneous articles and substances, genetically modified organisms and micro-organisms and (depending on the method of transport) magnetised materials and aviation-regulated substances.

DGI are proficient in handling miscellaneous dangerous goods, Class 9 Dangerous Goods. DGI have the ability to service all customer requests pertaining to the logistics of miscellaneous dangerous goods; packing, packaging, compliance, freight forwarding and training.

Reason for RegulationMiscellaneous dangerous goods present a wide array of potential hazards to human health and safety, infrastructure or their means of transport.

Sub-DivisionsThere are no subdivisions within Class 9, Miscellaneous Dangerous Goods.

Commonly Transported Miscellaneous Dangerous GoodsDry ice/cardice / solid carbon dioxide, Expandable polymeric beads/polystyrene beads, Ammonium nitrate fertilisers, Blue asbestos/crocidolite, Lithium-ion batteries, Lithium metal batteries, Battery powered equipment, Battery powered vehicles, Fuel cell engines, Internal combustion engines, Vehicles, Magnetised material, Dangerous goods in apparatus, Dangerous goods in machinery, Genetically modified organisms, Genetically modified micro-organisms, Chemical kits, First aid kits, Life-saving appliances, Air bag modules, Seatbelt pretensioners, Plastics moulding compound, Castor bean plant products, Polychlorinated

There may be a temporary delay in delivery on the given holidays below.

| Holiday/Festival | Region | Date |

|---|---|---|

| MAKAR SANKRANTI/MAGH BIHU | RAJ/KAR/ASM/AP/TELANGANA | 15 JAN 2024 |

| PONGAL/THIRUALLIVAR DAY | TN | ( 15, 16) JAN 2024 |

| REPUBLIC DAY | NATIONAL | 26 JAN 2024 |

| SHIV RATRI | NATIONAL | 8 MAR 2024 |

| DOL JATRA | ODI/WB | 25 MAR 2024 |

| HOLI (DULANDI) | PB/DEL/RAJ/UP/MP/JAMMU/CHHA/HP/ UK/ODI/BHR/JHARKHAND/AP/ASM/ TELANGANA/GUJ/MAH | 25 MAR 2024 |

| HOLI | BHR | 26 MAR 2024 |

| GOOD FRIDAY | KER | 29 MAR 2024 |

| GUDI PADWA/ UGADI | MAH/KAR/AP/TELANGANA | 9 APR 2024 |

| BAISAKHI | PB | 13 APR 2024 |

| TAMIL NEW YEARS DAY | TN | 14 APR 2024 |

| BEGALI NEW YEAR/RONGALI BIHU | WB | 15 APR 2024 |

| LABOUR DAY/ MAY DAY | WB/ODI/KAR/AP/TELANGANA/KER/TN/ MAH/BHR/ASM/JHARKHAND/NORTH EAST | 1 MAY 2024 |

| IDUL-UL-ADHA (BAKRID) | KER | 17 JUNE 2024 |

| RATHAYATRA | ODI | 7 JULY 2024 |

| INDEPENDENCE DAY | NATIONAL | 15 AUG 2024 |

| JANMASTAMI/GOKULASTAMI | NORTH INDIA/ GUJ/ JHARKHAND/ PB | 7 SEP 2024 |

| THIRUVONAM | KER | 15 SEP 2024 |

| THIRD ONAM | KER | 16 SEP 2024 |

| ANANTH CHATHURTHI / GANESH VISARJAN | MP | 16 SEP 2024 |

| ANANTH CHATHURTHI / GANESH VISARJAN | MAH | 17 SEP 2024 |

| GANDHI JAYANTI | NATIONAL | 2 OCT 2024 |

| DURGA PUJA | BHR/ASM/WB/ODI/NORTHEAST/JHARKHAND | ( 10, 11, 12) OCT 2024 |

| AYUTH POOJA | TN | 12 OCT 2024 |

| DUSHERA & VIJAYADASHMI | DEL/UP/MP/RAJ/HP/CHHA/MAH/GUJ/ UK/KAR/AP/KER/PB | 12 OCT 2024 |

| DURGA PUJA | ASM/WB/ODI/NORTHEAST/JHARKHAND | 13 OCT 2024 |

| DEEPAVALI & KALI PUJA | NATIONAL (Except KERALA) | 1 NOV 2024 |

| KANNADA RAJOTASAVA | KARNATAKA | 1 NOV 2024 |

| DEEPAVALI / GOVARDHAN PUJA / VISHWAKARMA PUJA/ GUJRAT NEW YEAR | DEL/RAJ/UP/PB/ HARYANA/GUJ/WB/MP/CHHA | 2 NOV 2024 |

| BAHUBEEJ/BHAI DUJ | MAH/GUJ | 3 NOV 2024 |

| CHHATH PUJA | BHR/ JHARKHAND | ( 7, 8) NOV 2024 |

| GURU NANAK JAYANTI | PUNJAB (PB) | 15 NOV 2024 |

A Slight Change in the Fuel Surcharge!

The fuel surcharge charged in India is unique for every logistics operator. Recent changes and upward hikes in fuel price, freight and airport handling charges by various airlines & co-loaders have increased our operational costs significantly. As a result, we are compelled to increase our fuel surcharge by 40% on basic price (w.e.f. April 2024).

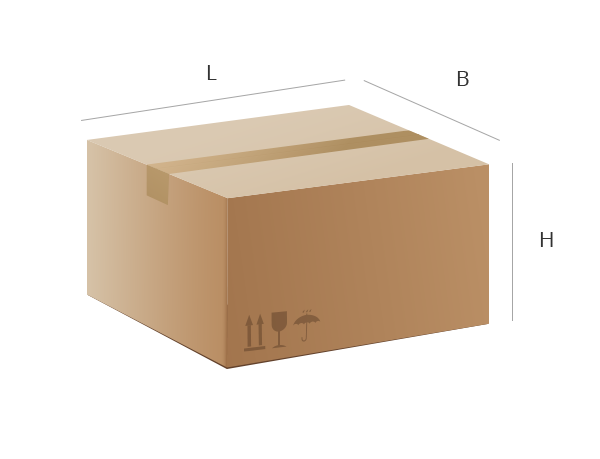

Pricing Method For Your Light-Weight Consignments

Light-weight consignments occupying a large space due to dimensions need to be charged as per the volumetric weight calculations as follows:

Volumetric Weight = LxBxH / 5000 in centimetres

2. Domestic Air Mode:Volumetric Weight = LxBxH / 6000 in centimetres

3. Road Express:Volumetric Weight = LxBxH / 4500 in centimetres

4. International Shipments:Volumetric Weight = LxBxH / 5000 in centimetres

For Parcels having a length of more than 110 cm in Air & 180cm in Surface mode, the weight will be charged doubled. Similarly, a single piece of more than 80 kg cannot be booked without an added cost and prior approval from the operations department.

Beware Of The Malicious Activities

Trackon never requests payment or personal information in exchange for goods or services via e-mails or social platforms. If you receive any of these communications, please do not reply. Your interaction may result in a financial loss. Please be wary of such fraudulent requests.

Common Warnings of Fraud:- Unexpected requests for money in return for delivery of a package, often accompanied by an unusual sense of urgency.

- Online exchange of a receipt that may look altered or where the AWB number is not trackable online or seems unusually short or long.

- Links to misspelled web addresses (trackon.co.in , trackon-courier.com etc.)

- Claims about winning a large sum of money, expensive items or the lottery.

- Requests to share credit/debit card numbers.

- Fraudulent calls or e-mails that request online payments.

Mapping Symbiosis Between Business & Social Welfare

| S. No. | Particulars |

|---|---|

| 1. | INTRODUCTION |

| 2. | TRACKON COURIERS POLICY |

| 3. | OBJECTIVE |

| 4. | SCOPE |

| 5. | CSR COMMITTEE |

| 6. | CSR EXPENDITURE |

| 7. | BASE LINE SURVEY & DOCUMENTATION |

| 8. | REFLECTION OF CSR ACTIVITY |

| 9. | PUBLICATION OF CSR POLICY |

| 10. | POLICY REVIEW AND FUTURE AMENDMENT |

| 11. | EFFECTIVE DATE |

The concept of Corporate Social Responsibility (“CSR”) has become crucial in the modern world. The contemporary views of the Corporate sector believe that the efforts of the government alone are not enough to achieve success in its endeavour to uplift the downtrodden society and hence there it has catapulted its contribution towards society by stepping further in this direction.

Moreover, the government, realising the above fact, has introduced and enforced legislations which provide for obligations of the corporate sector in the areas of CSR. With the rapidly changing corporate and regulatory environment, the advent of more functional autonomy, operational freedom etc., the company has adopted CSR as a strategic tool for sustainable growth. For the company in the present context, CSR is not only an investment of funds for social activities but also the integration of business processes with social welfare.

Trackon Couriers PhilosophyTrackon Couriers Private Limited, having its registered office at 135 A Rani Khera New Delhi -110081 (Hereinafter termed as ‘Trackon Couriers or the Company) was incorporated in 2002. Reaching out to underserved communities stays at the very core of our foundation. Our policy will focus on livelihood, health care, education and infrastructure to bring measurable improvement in the quality of life of unprivileged communities.

ObjectiveThe main objective of Trackon Couriers' CSR Policy is to lay down guidelines for the Company to make CSR its key business process for sustainable development in the society where the Company operates, thereby complying with the provisions of the Companies Act, 2013. It aims at supplementing the role of the government in enhancing welfare measures of society based on the immediate and long-term social and environmental consequences of the company’s activities.

ScopeThe Company proposes to implement its CSR activities in the following areas: -

- Eradicating hunger, poverty and malnutrition, promoting health care including preventive health care and sanitation promoting education, including special education and employment enhancing vocation skills, especially among children, women, the elderly, and the differently able and livelihood enhancement projects.

- Promoting gender equality and empowerment of women, setting up homes and hostels for women and orphans.

- Setting up old age homes, daycare centres and other facilities for senior citizens and measures for reducing inequalities faced by socially and economically backward groups.

- Ensuring environmental sustainability, ecological balance, protection of flora and fauna, animal welfare, agroforestry, conservation of natural resources and maintaining the quality of soil air and water.

- Protection of national heritage, art and culture including restoration of buildings and sites of historical importance and works of art.

- Setting up public libraries.

- Promotion and development of traditional arts and handicrafts.

- Measures for the benefit of armed forces veterans, war widows and their dependents.

- Training to promote rural sports, nationally recognized sports, Paralympic sports and Olympic sports.

- Contribution to the Prime Minister’s National Relief Fund or any other fund set up by the central government for socio-economic development and relief and welfare of the Scheduled Caste, the Scheduled Tribes, other backward classes, minorities and women.

- Rural development projects.

- All other activity as may be prescribed in Schedule VII of the Companies Act, 2013 as amended from time to time.

- The activities which are undertaken in pursuance of the normal course of business of a company.

- CSR projects/programs or activities that benefit only the employees of the company and their families.

- Any contribution directly/indirectly to a political party or any funds directed towards political parties or political causes.

- Any CSR projects/programs or activities undertaken outside India.

Under the provision of Section 135 of the Companies Act, 2013, the Board of Directors of Trackon Couriers constituted a CSR Committee as per its Resolution dated 18.02.2015. The following are the members of the Committee.

| S. No. | Particulars | Designation |

|---|---|---|

| 1. | Mr. Prabhat Kumar Anand | Chairman |

| 3. | Mr. Dinesh Kumar Rautela | Member |

| 3. | Mr. Yoginder Kumar Dabas | Member |

| 4. | Mr. Pramod Kumar Nourangi Singh | Member |

Mr. Prabhat Kumar Anand shall be the Chairman of the Committee. However, in his absence, Mr. Dinesh Kumar Rautela shall preside over the meeting.

No. Of MeetingsThe Committee shall meet at least four times in a calendar year with a maximum gap not exceeding 120 days and as when the need arises.

Quorum Of The CSR Committee MeetingTwo members of the committee shall constitute the quorum of the meeting. In case the quorum is not present within 15 minutes from the time of holding the meeting, then the meeting shall stand adjourned to the same day of the next week and at the same place and time unless otherwise decided by the committee chairman.

Here are the functions of the CSR Committee:

- Recommend CSR activities as stated under Schedule VII of the Companies Act,2013.

- Recommend the CSR Budget.

- Obtain the status of spends made out of the allocated CSR amount on the CSR activities by the Board of Directors of the company following the Act and the CSR rules.

- Create a transparent monitoring mechanism for the implementation of CSR initiatives in India.

- Submit the reports to the board on the CSR activities undertaken by the company.

- Monitor CSR Policy from time to time.

- Authorise executives of the company to attend the CSR committee meetings.

The provisions of the Companies Act, 2013 read with rules made there under, mandate companies meeting the qualification criteria to allocate a certain portion of their annual net profits during the three immediately preceding financial years to be spent on CSR activities shall fall under the purview of Schedule VII of the Companies Act, 2013.

The CSR expenditure shall be recommended by the CSR committee and subsequently to be approved by the Board of Directors. In case the company fails to spend the projected amount on CSR activities, the committee shall obtain from the Board of Directors of the company, the reasons for such failure and record the same in its further meeting.

Base Line Survey & DocumentationIn the CSR activities where the Community Development Program is involved, a baseline survey is essential to be carried out and cost-benefit must be analysed in the proposed scheme through survey.

The CSR activities for providing infrastructural facilities like educational institutions, where social benefit is involved, a baseline survey is not required. However, cost-benefit and justification for any project has to be ascertained. Documentation relating to CSR approaches, policies, programs, expenditures, procurement, etc. should be prepared meticulously and put in the public domain, (particularly via the Internet).

Reflection Of CSR ActivitiesAn annual audit of all activities undertaken by the company would be done by the Company’s auditor, which would form a part of the Statutory Audit. The Annual Report of the company shall include a section on CSR outlining the CSR Policy, CSR Committee, CSR initiatives undertaken by the company, the CSR spending during the financial year and any other information as required by the prevailing law.

Publication Of The CSR PolicyAs per the CSR Rules, the contents of the CSR Policy shall be included in the Directors’ Report and the same shall be displayed on the Company’s website.

Policy Review And Future AmendmentThe Committee shall annually review its CSR Policy from time to time, make suitable changes as may be required and submit the same for the approval of the Board.

Policy Review And Future AmendmentThis Policy is effective from April 1st, 2018.